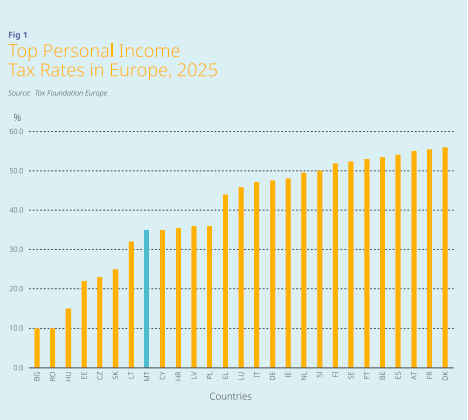

At 35 per cent, Malta’s personal income tax systems are in the lower range of European Union’s tax spectrum, making it “significantly more tax attractive” than much of Western and Northern Europe, according to Malta’s Pre-Budget consultation document for 2026.

Released today, the Pre-Budget looks at the overall financial, economic and social situation and outlook of the country ahead of the official Budget that will be presented in October.

While Malta does not offer the ultra-low rates seen in some Central and Eastern European countries, such as Bulgaria and Romania (both at 10 per cent), or Hungary (15 per cent), it remains significantly more tax attractive than much of its counterparts Western and Northern Europe.

Additionally, compared to its regional peers in Southern Europe, Malta’s rate is particularly competitive.

Italy’s top rate stands at 47 per cent, Greece’s at 44 per cent, Portugal’s at 53 per cent, and Spain’s reaches as high as 54 per cent. Malta’s relatively moderate top rate thus places it among the most favourable personal tax jurisdictions in Southern Europe.

Looking more broadly, countries in Western and Nordic Europe consistently exhibit higher personal income tax burdens, with France, Austria, and Denmark all reaching the 55 per cent mark.

In most developed economies, personal income tax systems are structured progressively, meaning that individuals are taxed at increasing rates as their income rises.

Progressive taxation typically involves a series of income bands or brackets, with higher rates applied to each successive level of income. The highest of these – known as the top marginal tax rate – is often used as a benchmark for comparing tax burdens across countries, as it reflects how heavily high-income earners are taxed and indicates the overall progressiveness of a country’s tax system.

Malta follows this same structure, applying a progressive tax system with increasing rates across defined income brackets.

In 2025, Malta’s top statutory personal income tax rate remains at 35 per cent, which is paid on chargeable income of €60,000 or more, an attractive allure for the small island nation.

‘Your past doesn’t disqualify you’: Growth Gurus Founder opens up on quitting drugs

His real wake-up call was the realisation that he was being horrible to his family.

QLZH’s Steve and Michael Mercieca share lessons for first-time bond issuers

QLZH doubled down on its strengths and pursued a diversified strategy to limit risk.

Graziella Axisa appointed Director of Sales & Marketing at Hyatt Regency Malta

Graziella says she's 'excited to step into this new chapter.'

Narcissistic behaviour in leadership: Awareness, impact and healthier ways forward

How can leaders identify narcissism and how can they tackle it?