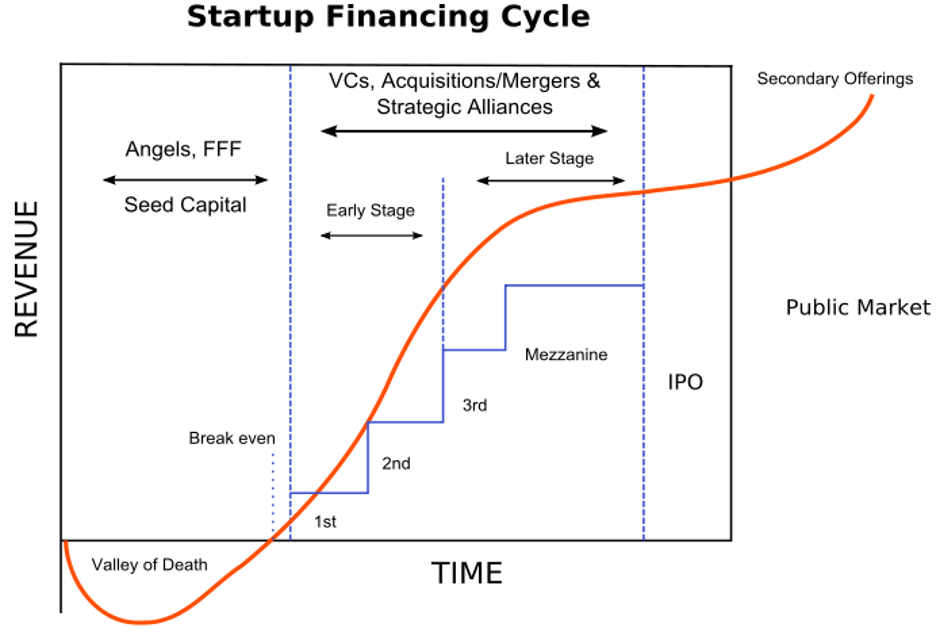

Although most people will only mention banks as a source of finance, various other alternatives have evolved and have surged in popularity in Europe. This has however, not been the case in Malta. This article will explore the different financing options and link them to the respective startup stage.

Pre-seed capital

A startup idea has been developing in your head and you decide to embark on a startup journey. Perhaps you have jotted down some notes on a piece of tissue or even developed a low fidelity prototype. This is like cutting a carrot top and placing it in water to grow into a flowering plant to collect the seeds. To move forward, you need some funding to enable you to focus on your idea full time, carry out better market research and start creating the first MVP or formally forming the enterprise. At this stage, one can generalise that the funding options available to you are:

FFF (Family, Friends and Fools): These would typically fall in two categories. They are either the believers who want to support your project, or the ones that are fed up with you talking about your idea and would rather have you give it a try and move on to working on it. They would hope that you would remember them when your idea goes through the roof and you become super rich. The availability of this type of funds depends a lot on family background and network circle. It is not very common in Malta as these would typically encourage you to go into employment

Incubators: Following an assessment of your idea, these would typically offer support in the basic needs of a startup, like office space, equipment, mentorship, and many other support mechanisms. Most also offer some funding scheme or pre-seed money. Examples in Malta are TakeOff at the University of Malta, KBIC offered by Malta Enterprise and the recently launched Basement2Boardroom by a private entity.

Grants or funding competitions: From time-to-time Government or other entities launch schemes or competitions that would include some pre-seed funding. Recent examples which are open at the time of writing include JCI’s SeedGreen, Pitchora, as well as the recently closed TOSFA. Moreover, the StartinMalta initiative also includes the Startup Finance and BStart funding schemes through Malta Enterprise.

Seed capital or early-stage investment

Whereas pre-seed funding is focused on the initial assessment of the idea and the setting up of the business, you then move to the next phase of your startup journey. Continuing with the carrot top analogy, you will now be taking the seed and planting it in deep soil. So now you will be launching the business and focusing on sustainability by launching in the market and striving for a good product-market fit. Traditional alternative financing sources here would typically be:

Business Angels: These are usually previous successful startup founders themselves or CEOs who decide to invest money in other startups to back companies in their respective field of expertise or given their potential growth and current market situation. The typical difference from Venture Capitalist (VC) is that Business angels often invest their own money and at an earlier stage than VCs. This is an ever-growing mechanism in Europe, although it is not as big as it is in the US. In Malta, unfortunately this is also quite lacking and there is no real knowledge of the volumes invested by Business Angels as when this happens in Malta it is often under the radar and unknown to the market. Business angels sometimes also organise themselves through Syndicates and follow a lead investor to share resources, risks and also improve and diversify their portfolio of startups. We have recently seen the launch of Business Angels Malta but this is just at the beginning and more efforts need to be made to grow this avenue of funding in Malta.

Accelerator programmes: Organisations sometimes offer a programme to provide capital, mentorship and office space to start up, typically in exchange for equity. These programmes’ main intention is that of accelerating the growth phase and therefore they provide the resources, contacts and support for the startup to achieve results faster, including making it more investor-ready for the next round of funding. There are a number of these programmes in Europe, such as Seedcamp and Techstars, but unfortunately, we do not really have these types of programmes in Malta yet. Government, in the last Budget, had announced that it will issue a tender for setting up such a programme.

Crowdfunding: This could be both reward-based or equity crowdfunding. The former means that backers of the startup will be funding it by providing capital in exchange for something in return. This can be seen as pre-sales. That is, attracting paying customers before launching the product. The latter, as the name would indicate, means that the now investor, not backers, will be getting a share in the business. They would then also benefit from future earnings or exit of the company. There is a huge number of platforms offering both types of crowdfunding in Europe. In Malta, ZAAR is the only platform, and it only offers reward-based crowdfunding so far.

Corporate venture: This is probably the option that is most versatile and can be attributed to all the stages of startup development as it completely depends on the aims and objectives of the corporate. This is when an established organisation invests in external startups. This would typically be a startup within the same industry that the corporate would be aiming at achieving advantage through the startup’s development or disruptive nature. The investing corporate would provide the startup with management expertise, strategic direction and funding. Like all the others, this is a growing mechanism. In Malta we have seen some initiatives, albeit limited, such as Go Ventures and Harvest.

Growth stage – Series A,B,C

If you made it to this stage, one would assume that as a startup you have a clear definition of your offering and the market size. While gaining traction on the ground, you have also hit certain user or sales milestones. You are now thinking of scaling up, disrupting existing systems or establishing yourself more in the market. Starting with a Series A type of funding round, these would typically range from €1m to €5m. The main avenues in Europe would be the following three, which unfortunately are also lacking and practically nonexistent in Malta:

Venture Capitalists firms: These firms would typically eventually own between 10 per cent to 30 per cent of the business, and would aggressively aim to make the business focus on efficiency and on growth in market share or user base.

Loan-based Crowdfunding: This is another type of crowdfunding where businesses with certain traction and growth strategy could pitch their plan to the public and collect funds, in the shape of a loan, which would be payable over several years or convertible into future share issues.

Blended Instruments: In recent years we have seen the developments of financial instruments that combine various other funding avenues and are boosted with EU funds usually provided by EIB or EIF. For example, combining EU Funds with Crowdfunding and Business Angels or providing this funding with additional guarantees to secure loans which would otherwise not be possible.

Initial Public Offering: Moving on, with raises over €6m one would be moving into Series B, C, and other rounds of funding. This would be typically include a US VC or some participation from the US, as the EU market has not really developed this mechanism. Alternatively, one could go public through the capital markets with an IPO (Initial Public Offering) with Stock Exchanges or MTFs (Multilateral Trading Facility) such as Prospects in the case of Malta.

DeFi special mention

Through the advancement of Decentralised Finance, new avenues are developing which can be applied at the different stages. These would typically be new adaptations of previously existing models now using decentralised infrastructure and cryptocurrencies. For this reason, they would be limited to a few industries or startups, such as Initial Coin Offerings (ICO), Security Token Offerings (STO) and more. This is a developing space with clear problems and concerns at this stage, and one would need to see how they develop further.

Conclusion

The various options listed above give an indication of the different avenues in the startup world. There are certainly others that can be added as some are tweaked and developed. However, a startup needs to consider the right source of finance for its stage of development. Each option has its main features and objectives – seeking the wrong one at the wrong time could result in a lot of wasted energy and time. Apart from time, you also need to consider your personal motivations. For example, if you aim to remain a local startup with stable client base, seeking investment from investors might not be the right option.

Lastly, unfortunately, not all the options are available in Malta yet. The situation has clearly been improving over the last years, but there is a lot more to be done. Schemes like the Seed Investment Scheme need to be promoted further, and awareness of this type of investment needs to also increase and be encouraged. Furthermore, one needs to also promote and focus on different types of startups. Startups which offer good sustainable solutions or impacting investing also need to be promoted with a shift in focus away from purely High Tech High Growth Startups. (see my previous article on ESG and Finance)

Do you agree with the different classification? Or do you feel that there are other options or examples in Malta worth mentioning? Get in touch and share your thoughts.

Say goodbye to your 60-hour work week

7 tips to stop business leaders from overworking.

Reach new heights: 6 key strategies to accelerate business growth

Growth is an ongoing process that business leaders have to work hard towards and be patient with.

Embracing change – My journey beyond the comfort zone

The comfort of routine can dull the spark of innovation and can dampen the spirit of growth, leaving both oneself ...

Adieu email stress – Five tips for business leaders to breeze through their inbox

Going through emails is not only a tedious task but it also leads to a drop in productivity.