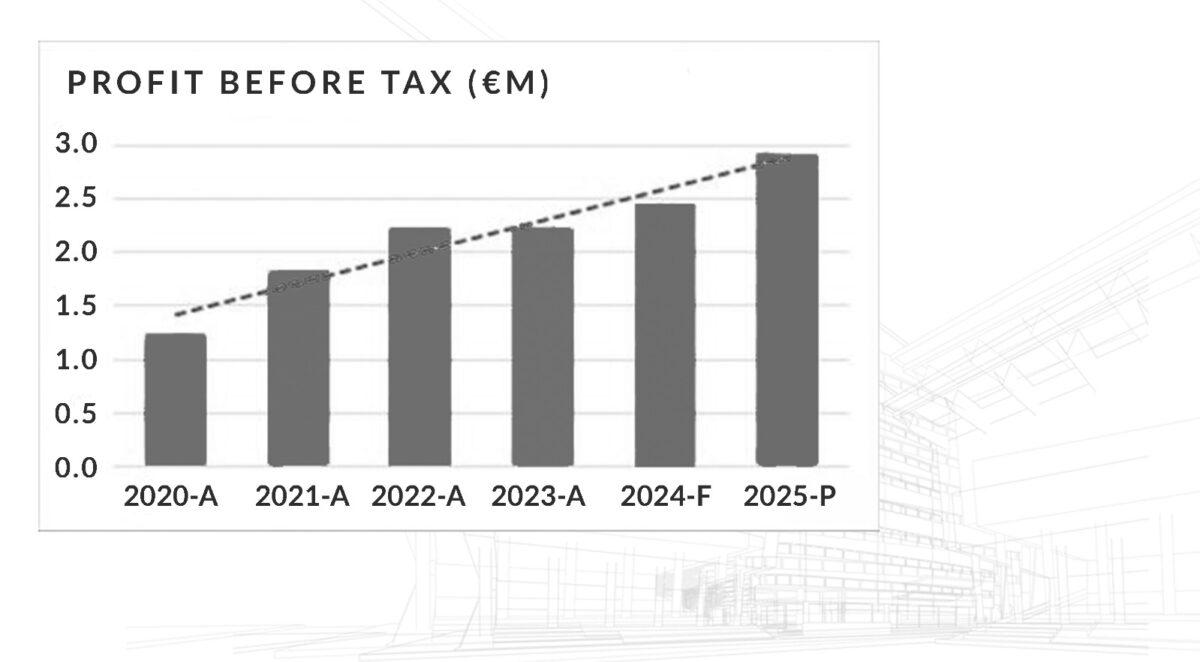

In today’s fast-paced IT landscape, few industries are as dynamic and as full of potential as the Computime Group which has achieved an annualised profit growth rate of 22 per cent over the last three years and yet can proudly boast a 45-year history of success, low staff turnover, quality customer service at home and overseas and an admirable business model. As the local business landscape keeps a sharp eye on global digital transformation, companies like Computime are at the forefront of this revolution carving out new paths for growth, innovation and profitability.

In this interview with Computime Chairman, Tony Mahoney, we delve into his perspective on the company’s latest milestone: the launch of its equity share offer. Given the great opportunities and challenges of the current market environment, he is confident that this move presents a unique and lucrative opportunity for investors who understand the long-term potential of a mature but dynamic and successful ICT company like Computime, that has consistently proven it is not only here to stay, but set to keep growing at a rapid pace year on year.

Tony shares insights into the strategic vision that positions Computime for success, and why the potential rewards of smart equity ownership should outweigh bonds and feed further growth of the Maltese economy. As he takes us through the rationale behind the share offer, we explore why he believes this is not just a typical investment opportunity, but a strategic step toward positioning the company – and its investors – at the heart of an industry that enjoys local and global growth.

Launching a share offer is a key milestone for any organisation. What was the reaction from customers and employees?

Our Executive Team was involved from the outset, and we also realised early on that to secure continuity and growth, the leadership team needs to have ‘skin in the game’. In fact, we are pleased that all Senior Executives became shareholders in the company earlier this year. We employ a team of almost 100 professionals, many of whom have been with us for several years. In fact, I am pleased to say we have outperformed industry average retention of staff and customers for many years, so it is a great satisfaction that such a large number of them will be participating in the offer by purchasing shares in the company. Ownership brings success.

The new capital structure will ensure that the company will build upon the great work of its founding shareholders who will retain a sizeable shareholding and manage the risks associated with businesses’ succession.

Local equity offers achieved mixed levels of success in the past; why should people of Malta invest in this offer?

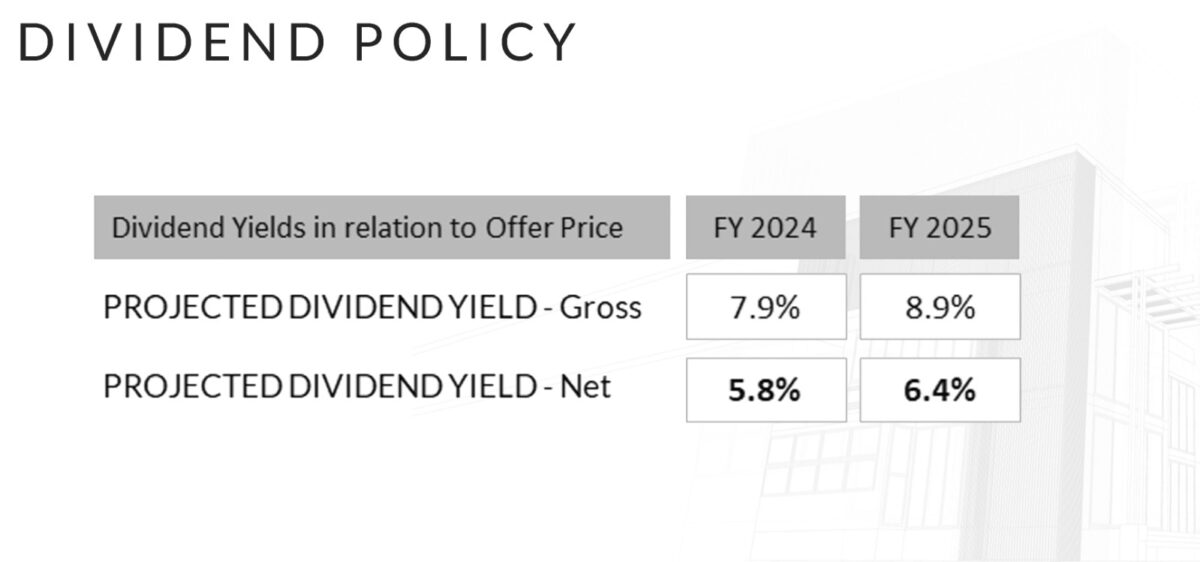

Maltese investors are prolific investors who invest in a mix of bonds and equities. Whilst bonds offer a healthy rate of return, equity offerings and particularly those of the quality of Computime, offer good dividend returns and a rare opportunity to invest in shares which should also offer significant capital growth.

Generally, investors allocate a part of their portfolio to cash, part equities and bonds as well as other asset classes such as property.

Individuals invest in companies that offer stability but also continued strong growth opportunities in developing sectors like FinTech and cyber security. Computime ticks all the boxes having been around for 45 years and continuing to achieve consistent double-digit growth.

What value does this share offer bring to the local equity market?

We bring to the market an investment backed by more than four decades of stability and growth. We put our reputation forward as one of the leading ICT operators in the country and we are offering investors the possibility to participate in the tech sector, through a local company with a diversified tech portfolio that includes IT infrastructure, cyber security, AI, Fintech, ERP and various other software solutions.

In the prospectus you disclosed that placement agreements were signed before launching the offer.

Yes indeed. In line with our cautious approach, we met institutional investors and financial intermediaries and the reaction and feedback we received was positive. In fact, we even disclosed in the prospectus, that almost 40 per cent of the offer had already been subscribed to by such institutional investors. The financial intermediaries did indicate that local investors have a general preference for bond issues. This has been more pronounced during the past couple of years because of the gradual increase in interest rates which are now beginning to fall again. The intermediaries all appreciated Computime’s strong position with regards to dividend payout and growth potential.

What should investors expect from the business over the next couple of years?

They should expect more growth in the same way that we have managed to increase our operating profit by an annualised rate of 22 per cent over the last 3 years. They should also expect a strong dividend payout right away – as we have disclosed in the prospectus, the projected dividend yield for next year is 8.9 per cent gross and 6.4 per cent net. This is already very attractive, but more importantly the potential to increase further this dividend over the coming years together with capital growth in line with our growth trajectory.

Caspar Lee returns to Malta for the fifth edition of the Start-Up Festival

His involvement is expected to bring additional international attention to the event.

Malta’s economy ‘well-positioned for future success’ – HSBC Malta CEO

The bank has reported a profit before tax of €58.7 million in first half of the year.

Maltese ‘don’t fully grasp what it means to be an independent republic’

Software developer Alex Portelli believes a new online tool can make the Maltese Constitution and its history more accessible to ...

Edward Scicluna to resume duties as Governor of the Central Bank of Malta

He was appointed Central Bank Governor in 2021.