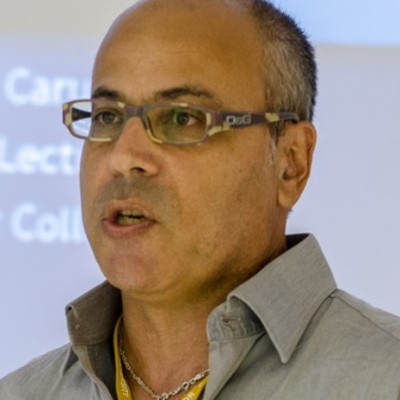

After months of meeting business owners, investors, and partners across industries, Hatten M&A Advisory Founder Jonathan Shaw says there are still several misconceptions business owners need to address before pursuing a sale.

Having recently launched Hatten M&A Advisory with partners Damian Mifsud, Francesco Grasso, and Matthew Buhagiar, supported by consultants Julian Mizzi, and Sean Galea, Mr Shaw explained that while appetite for mergers and acquisitions remains strong, the process is rarely straightforward.

“M&A isn’t a sprint, it’s a marathon of numbers, emotions, and timing,” he wrote in a recent LinkedIn post. “It’s technical, complex, and you can’t take on more than you can handle if you want to do it right. Having the right team beside you makes all the difference.”

Mr Shaw said that despite ongoing market interest, business owners still tend to misunderstand some key realities when preparing to sell. He outlined four common misconceptions:

1. Valuations must be realistic

“It’s great to have potential, but multiples need to make sense and buyers need room for upside,” Mr Shaw noted. Inflated expectations can be a deal-breaker, especially if sellers focus on projections rather than current performance.

2. If you’re the business, you’ll likely need to stay

For founders deeply involved in daily operations, a transition period is often necessary. Buyers typically expect a level of continuity to ensure a smooth handover and maintain client or staff confidence.

3. Buyer outreach must be strategic

A targeted approach is crucial, Mr Shaw explained. “Too narrow and you limit opportunities; too broad and you lose control.” Identifying and engaging suitable buyers requires balance and confidentiality.

4. Structure comes before price

According to Mr Shaw, the structure of the deal — including terms, conditions, and earn-outs — should take precedence over the headline number. “The first focus should be on deal mechanics, not just the number,” he wrote.

Reflecting on these lessons, Mr Shaw concluded that “great deals are built on trust, patience, alignment, and expertise.”

Since its launch earlier this year, Hatten M&A Advisory has positioned itself as one of Malta’s few dedicated firms focusing exclusively on mergers and acquisitions. The firm supports shareholders planning strategic exits or successions, offering guidance across sectors such as FMCG, retail and distribution, hospitality, iGaming, fintech, and regtech.

Evening networking is a punishment for working parents – Mark Debono

The issue, he argues, lies in how professional life continues to be structured as if parenting does not exist.

ITS appoints Simon Caurana as Director of Centre of Contemporary Tourism

This role requires him to serve as the founding strategic leader of the newly established centre.

Thomas Agius Ferrante appointed CEO of Xara Collection

Thomas Agius Ferrante will focused on strengthening The Xara Collection as one of Malta’s most known hospitality companies.

Andrew Hogg is The Brewhouse Malta’s new Business Development Manager

Andrew Hogg is also Executive Director at The BrewHouse Malta.